Bank Reconciliation

Presentations | English

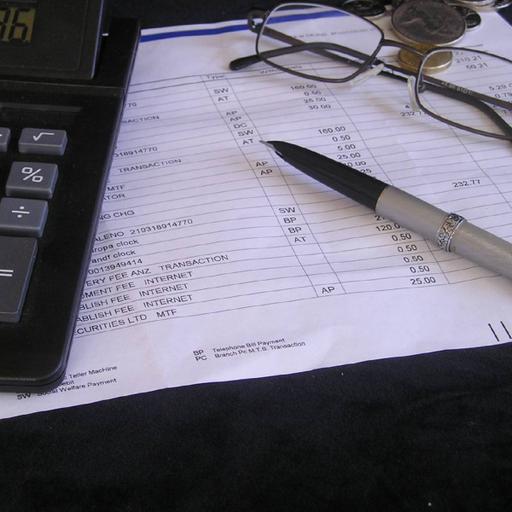

Bank reconciliation explains the difference between the bank balance shown in a company’s bank statement, as supplied by the bank and the corresponding amount shown in the company’s own account records at a particular point in time. Due to the amount of time between when a bank statement is prepared and when it is received by a business, the document may not accurately reveal what the business actually has in terms of cash. This is why reconciling the bank statement is necessary. To minimize the amount of work involved, it is a good practice to carry out such reconciliations at frequent intervals. Reconciliations are generally performed by specialized accounting software. The person reconciling the accounts adjusts one column by adding deposits that had not yet been recorded and subtracting check and other outlays that had not yet been cashed when the statement had been prepared. The reconciliation is not complete until the adjusted column equals the unadjusted column.

Free

PPTX (50 Slides)

Bank Reconciliation

Presentations | English